The free game “Free Retirement OddsFinder” (aka Free R-OFer for short) is designed to let you learn about the financial planning the way you learned to walk. Unlike the current books and tapes, here is the ability to learn the value of financial life planning through trial and error. In this free version of the game you can take the first steps in understanding important aspects of a capitalistic game many of us don’t know we are playing.

Instead of sitting there and taking in a lecture, or reading a static single storyline book, here is a game that lets you learn by doing. Not only that, but for each of your plans here are a couple of charts that provides the smallest glimpse into the power of choice over the odds of attaining various levels of financial success.

Features:

Detailed Directions and Informational Explanations

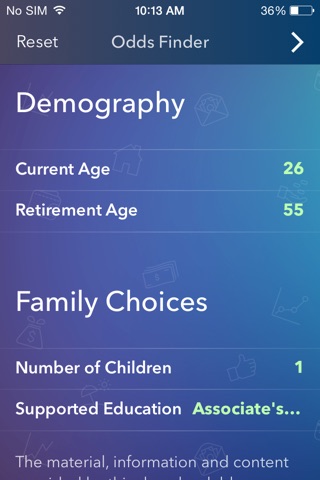

Selectable life planning:

•Starting and target retirement age

•Number of children and level of support you plan on providing

•Decisions impacting income and major expense

•Ability change income and expense decisions of life

•Decisions on retirement savings and type of investments

Illuminating results with Interpretations and Recommendations

•“Lifetime Cashflow” shows the odds of making different amounts of money over your lifetime.

• “Nest Egg Generation” shows the odds of making a retirement savings of various sizes.

Whether, you want to explore the POWER OF CHOICE yourself or get this game to get it into the hands of someone else important to you, here is a simple way to start ILLUMINATING how CHOICES IMPACT THE FUTURE!!! ENJOY!!!!!

If you enjoyed this game, you’ll enjoy these additional features in the full version:

•Additional options in changing your income and expense decisions at different stages of life.

•Ability to change retirement saving amounts and investment choices at different stages of life.

•“Where did the Money Go” charts what happened to the money.

•“Who is benefiting from your labors?” explains how much you paid yourself vs various lenders.

•“Making your money work for you” explains how successful you were in getting your money work for you.